Let us discuss a place packed with possibilities in 2025—and no, it is not another overhyped market or tech bubble. It’s about Africa.

Indeed, the region that had been silently on the investment sidelines is now drawing full attention from investors worldwide. And not without good reason. There’s something electric happening across Africa—driven by its booming youth population, untapped natural resources, fast-moving tech scene, and a refreshing wave of policy reforms. The smart money? It’s starting to pour in.

Here’s a stat that might stop you in your tracks: over 60% of Africa’s population is under 25. That’s not just a number—it’s a massive indicator of what’s to come.

We’re talking about a generation that’s digitally native, hungry for progress, and rapidly stepping into the workforce. These young consumers are demanding more—better education, smarter tech, more accessible healthcare—and they’re willing to pay for it. As incomes rise, so does spending power. For investors, that’s like watching the starter gun go off in a marathon of opportunity.

It’s not just labor potential; it’s market growth at scale.

Here’s the thing about Africa: it’s not trying to catch up to the world—it’s leapfrogging right past traditional systems.

For instance, consider fintech. Mobile money has completely changed what banking looks like in countries like Kenya and Nigeria. No banker? There is no issue. Digital wallets and smartphones have produced quick, inclusive, very entrepreneurial financial ecosystems. Five years ago, this surge of technical leapfroggings did not open doors to business opportunities in Africa. Now it is doing so.

E-commerce, edtech, agritech—you name it, Africa is sprinting ahead in ways that feel tailor-made for investors with a digital edge.

Now let’s talk roads, railways, and the not-so-glamorous stuff that actually builds nations.

Africa’s infrastructure gap—currently pegged at around $130 billion a year—isn’t just a challenge. It’s a goldmine for investors. Governments are finally stepping up, pouring money into transport, energy, and telecoms to support economic growth.

Take Egypt’s new capital city, or Morocco’s renewable energy mega-projects. These aren’t pipe dreams—they’re real, happening, and investor-backed. If you’re looking to invest in Africa, infrastructure is where long-term gains and societal impact intersect.

Here’s a sobering fact: over 600 million Africans still don’t have access to electricity.

But instead of sticking with outdated grids or fossil fuels, the continent is going green—with urgency. Africa is sitting on some of the world’s richest reserves of solar, wind, and hydropower. Countries like South Africa and Morocco are going all-in on renewable energy, and global investors are paying attention.

If your portfolio has even a hint of ESG ambition, Africa’s clean energy sector is calling.

You’ve probably heard the phrase “African Continental Free Trade Area” (AfCFTA) thrown around. It sounds like policy-speak, but it’s huge.

Picture this: 54 countries creating one seamless trading bloc. That means fewer tariffs, less red tape, and a unified market with over 1.4 billion consumers. It’s the kind of scale that gives even the EU a run for its money.

And it’s not just trade. Nations across the continent are cutting red tape, offering investor incentives, and straight-up improving how business gets done. For global investors tired of saturated Western markets, this is refreshing.

Of course, no conversation about Africa is complete without talking about what’s beneath its surface.

Africa holds about 30% of the world’s mineral reserves—and in a world shifting to electric vehicles and green tech, that’s a big deal. Minerals like lithium, cobalt, and rare earth elements are suddenly hot commodities. The Democratic Republic of Congo, for instance, is becoming a linchpin in the global clean energy supply chain.

It’s not just about mining anymore. It’s about strategic control of future industries.

Rwanda might not have been on your radar five years ago, but it should be now.

Kigali’s emerging as a serious financial hub, with its Kigali International Financial Centre drawing attention for its streamlined regulations and regional market access. It’s one example of how African countries are not just attracting investment—they’re structuring ecosystems to support it long-term.

From Lagos to Nairobi to Kigali, financial systems are maturing—and they’re doing it fast.

Because the continent is no longer a sleeping giant. It’s waking up—and roaring.

From demographics and digital innovation to natural resources and policy overhauls, investment opportunities in Africa are more compelling than ever. The continent isn’t just ready for investment—it’s actively shaping itself into a destination for forward-thinking capital.

Sure, there are risks. Every emerging market has them. But Africa in 2025? It’s offering something rare: high potential, early-mover advantage, and the chance to make a lasting impact while growing your stake in a future that’s just getting started.

So ask yourself—are you in, or are you going to watch from the sidelines?

This article is for informational purposes only and does not constitute financial, investment, or legal advice. Readers are encouraged to conduct their own research and consult with professional advisors before making any investment decisions. The views expressed are those of the author and do not necessarily reflect the official policy or position of any agency or organization mentioned.

Sources:

1. Why is Africa a good investment opportunity in 2025?

Because Africa is no longer quietly waiting on the sidelines—it’s entering center stage with a surge of transformative momentum. With over 60% of its population under 25, a swelling middle class, and a rapid embrace of technology, the continent offers untapped markets hungry for innovation. Combine that with infrastructure expansion, pro-business reforms, and the African Continental Free Trade Area (AfCFTA) unlocking a 1.4 billion-strong market, and you’re looking at early-mover advantage in one of the world’s fastest-evolving economic landscapes.

2. Which sectors are the most profitable for investment in Africa?

Several sectors are emerging as powerhouses of potential in 2025. Fintech leads the charge, disrupting traditional banking with mobile-first solutions. Renewable energy is gaining momentum as countries shift to sustainable power sources. Agribusiness and agritech are booming, addressing both food security and export markets. Meanwhile, e-commerce, infrastructure development, healthtech, and logistics are scaling fast. And let’s not forget mining—Africa is rich in critical minerals essential for the global clean tech revolution.

3. How can foreign investors start a business in Africa?

Launching a business in Africa as a foreign investor starts with choosing the right country and industry, as regulatory frameworks vary across borders. Investors typically need to register with local investment promotion agencies (like Nigeria’s NIPC or Rwanda’s RDB), obtain necessary licenses, and partner with a legal advisor well-versed in the host country’s commercial law. Many governments offer tax incentives, fast-track approvals, and investment guarantees under bilateral or regional treaties to ease the process and protect capital.

4. What are the risks of investing in Africa, and how to mitigate them?

Investing in Africa carries risks—as does any frontier market. These can include political instability, currency fluctuations, infrastructure gaps, or regulatory uncertainty. However, these are not deal-breakers. Risks can be mitigated through political risk insurance (e.g., MIGA or private insurers), local partnerships, and diversifying across markets and sectors. Staying updated with regional developments and working with vetted advisors can turn these risks into strategic opportunities.

5. What are the legal and regulatory requirements for investing in Africa?

Legal requirements depend on the country but generally include business registration, sector-specific licensing, foreign ownership rules, and tax compliance. Many nations are streamlining their processes to attract FDI—especially under frameworks aligned with the AfCFTA. Key international agreements, such as the OHADA business law system in Francophone Africa or bilateral investment treaties, often protect foreign investors. Due diligence, familiarity with local content laws, and clarity on repatriation of profits are essential for a compliant and sustainable investment journey.

Africa is increasingly catching serious attention from investors around the world. For many countries, growth prospects remain strong: improving economic fundamentals, demographic tailwinds, rising consumption and infrastructure gaps make for a compelling growth narrative. But, along with potential comes volatility: currency swings, shallow markets, uneven regulation. That volatility forces a choice, do you try to […]

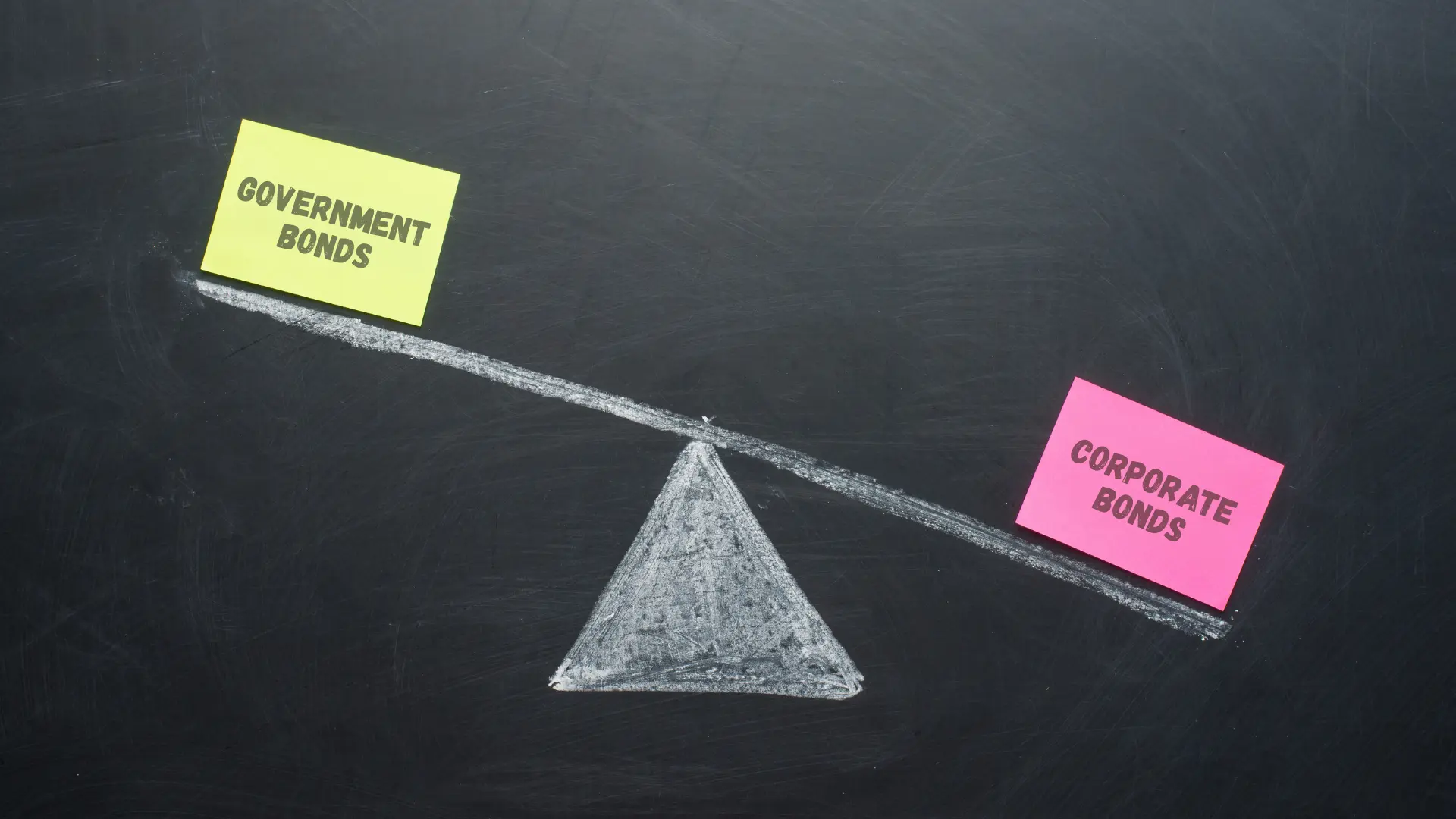

If you’re exploring investment opportunities in Africa, bonds are usually one of the first stopovers. The continent’s growth story, shifting interest-rate cycles, and rising corporate issuances mean there’s real activity for anyone looking to invest in Africa. But here’s the thing: not all bonds play by the same rules. Government debt and corporate paper behave […]

Introduction Agribusiness and mining are two of Africa’s biggest economic engines. One feeds the continent and supports nearly half of its workforce. The other powers global supply chains with the minerals needed for batteries, electric vehicles, and renewable energy. The real question for investors is simple: which one will drive Africa’s next decade of growth, […]