Here’s the thing: Africa is no longer sitting on the sidelines of the global rare earth game. It’s stepping in fast. For investors scanning the horizon for investment opportunities in Africa, this is one of the most strategic plays right now. From negligible output just a few years ago to what some industry analysts estimate could reach 9–10 % of global rare earth supply by 2029–2030, the continent is positioning itself as a critical link in the clean‑tech and defense supply chains of the future. That means new business opportunities in Africa across mining, refining, logistics, and manufacturing and multiple entry points for those looking to invest in Africa before the market fully matures.

Rare earth minerals, 17 metallic elements including neodymium, praseodymium, dysprosium, and terbium, might not sound glamorous, but they’re the invisible backbone of everything from EV motors and wind turbines to smartphones, satellites, and advanced medical scanners. Demand is projected to rise sharply, some forecasts suggest it could nearly quadruple by 2030, depending on EV and wind turbine uptake, and right now supply is heavily concentrated. China mines about 60–70 % of global output and refines around 85–90 %, according to USGS and IEA data, creating geopolitical and supply‑chain vulnerabilities.

That’s exactly why global powers, from the U.S. to the EU, Australia, and India, are aggressively diversifying and Africa’s underdeveloped but resource‑rich mining sector is emerging as a prime target. For investors, this is more than just a commodity play. It’s a chance to tap into business opportunities in Africa that span exploration, value‑added processing, infrastructure development, and high‑tech manufacturing.

Here’s what’s on track:

Two standout projects:

These are not speculative. They’re financed, permitted, and moving to buildout.

This shift opens more than mining, it opens industrial and investment opportunities across the value chain.

Western firms, Pensana, Mkango, Rainbow Rare Earths, Lindian, Ionic are leading the charge. Africa’s rare earth boom isn’t a China grab—it’s led by Canadian, British, Australian and South African companies.

Funds are flocking. KoBold Metals, backed by investors including Bill Gates and Jeff Bezos has committed significant funding to African mineral exploration, though specific figures for rare earths in Africa have not been independently confirmed. Good spots for equity play or JV entry include Songwe, Lofdal (Namibia), Longonjo (Angola), Makuutu (Uganda), and Ngualla (Tanzania).

Rare earth processing still mostly happens in China. That’s shifting. In early‑2025, South African asset manager Novare agreed with U.S. firm ReElement Technologies on a refinery + battery facility slated for construction H2 2025. In Australia, Iluka’s Eneabba refinery — scheduled to operate by 2027 — is set to be the country’s first integrated REE plant, with supply expected from projects including Lindian’s Malawi operations. It’s backed by government subsidies and has a long‑term supply agreement. Pensana’s Saltend plant in the UK aims to produce 5 % of global neodymium‑praseodymium demand by 2025, processing Angolan ore.

African governments are pushing for similar moves. In 2023, Zimbabwe announced a ban on unrefined lithium exports to encourage local processing and battery‑manufacturing partnerships. Uganda established a state mining company to hold stakes — reportedly around 15 % — in certain projects, and has been in talks with Ionic Rare Earths about local refining.

Mining creates ripple effects. New rail corridors (like Lobito in DRC) and ports are attracting allied attention—like a US $560 million investment to link Katanga’s mineral belt to export terminals. Governments want to link rare earth mining with broader value chains: battery parks, EV manufacturing zones, logistics hubs, industrial zones under AfCFTA.

Africa holds roughly 30 % of known global critical mineral reserves, but captures a much smaller share of the processed value — estimates suggest around 40 %. Weak regulation or corruption can stall projects. Some countries are still grappling with environmental and community issues around artisanal mining, like in DRC and Burundi.

Projects can be derailed by politics. South Africa’s Phalaborwa rare earth plan, expected to produce 1,900 tons/year is under threat after a U.S. executive order paused aid. Investors need clarity on host government policy and regulatory stability.

There are temporary imbalances. IIndustry reports indicate that neodymium‑praseodymium oxide production reached around 5,400 tonnes in 2024, but was projected to drop significantly the following year even as demand accelerates ~15 % in EVs and wind turbines. Smart players anticipate this and manage inventory, futures contracts, and refining pipeline timing.

Africa’s rise in rare earth mining isn’t hypothetical, it’s happening. The continent is securing nearly 10 % of global supply by 2029–2030, with marquee mines coming online in 2025. Backed by Western capital and strategic partnerships, it’s rewriting the narrative, from resource exporter to industrial partner.

If you’re eyeing investment opportunities in Africa, thinking about business opportunities, or are exploring how to invest in Africa’s new critical mineral economy, the rare earth space is where the global shift is happening. Long‑term benefits are more likely to come from building local value chains, infrastructure, and long‑term partnerships.

Sources:

The growing importance of rare earth minerals in African mining

African Rare Earth Projects Advance Amid Rising Global Demand

Mksngo Resources LTD. Jul 05, 2022 Press Release

Wikipedia+1

Rare earth projects advance in Africa

theaustralian.com.au+1

Wikipedia

Uganda sets up state-owned firm to take stakes in mining operations

US and China scramble to control Africa’s mineral riches

Africa’s Rare Earth Minerals Boom

Could Africa replace China as the world’s source of rare earth elements?

Democratic Republic of the Congo

Trump’s feud with South Africa could hinder hunt for critical minerals

1. Why are mineral resources important in Africa?

Africa’s minerals are more than just rocks in the ground. They’re economic lifelines, funding infrastructure, creating jobs, and powering industries from construction to clean energy. With vast reserves of gold, cobalt, platinum, and rare earths, the continent isn’t just exporting raw materials, it’s holding leverage in global supply chains that are shaping the future.

2. Why are rare earth minerals important?

They might not sound exciting, neodymium, praseodymium, dysprosium, but rare earths are the quiet workhorses of modern tech. They make electric vehicle motors spin, wind turbines turn, and your phone’s speakers hum. Without them, most of today’s high‑performance electronics, renewable energy systems, and advanced defense gear simply wouldn’t work.

3. What are the important minerals found in Africa?

Africa’s mineral map is a long shopping list for the modern economy, gold from South Africa and Ghana, cobalt and copper from the DRC, platinum from Zimbabwe, bauxite from Guinea, and rare earth elements from Malawi, South Africa, and Tanzania. Add in lithium, manganese, and graphite, and you’ve got the core ingredients for batteries, steel, electronics, and renewable energy tech.

4. How do rare earth minerals support clean energy and technology?

Rare earths are the muscle behind the green transition. Neodymium and praseodymium power the permanent magnets in EV motors and wind turbines. Terbium and dysprosium boost efficiency and heat resistance in high‑performance systems. The result? Lighter, more powerful, longer‑lasting clean‑tech solutions, all critical if we want a low‑carbon future to actually work at scale.

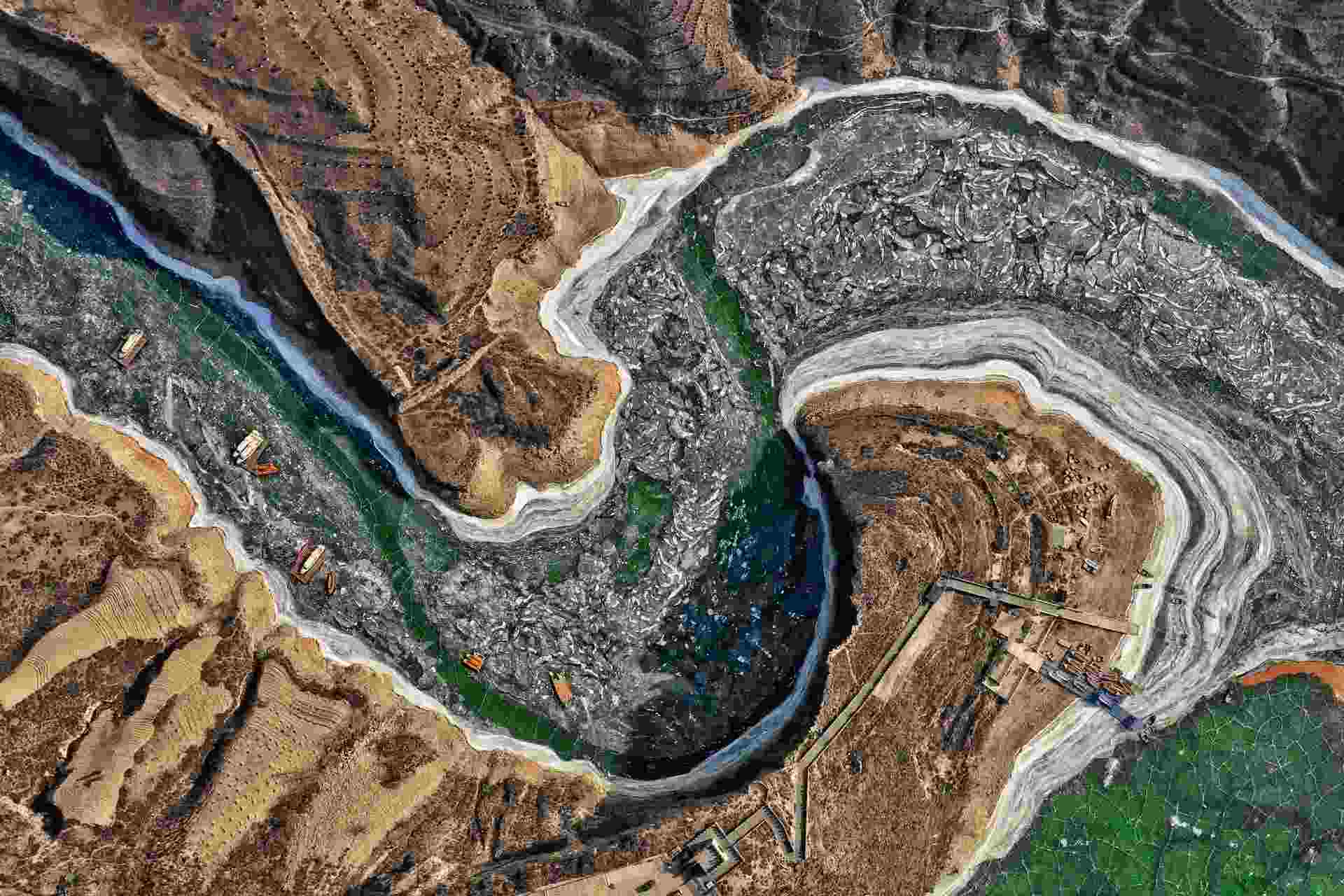

5. What are the environmental impacts of rare earth mining in Africa?

Here’s the flip side, rare earth mining isn’t impact‑free. Extracting and processing them can create toxic waste, water pollution, and landscape damage if not managed carefully. In parts of Africa, weak regulation has led to unsafe practices, especially in artisanal mining. The opportunity is huge, but so is the responsibility, sustainable methods, proper waste handling, and strong community engagement are non‑negotiable if the sector’s going to grow without leaving a scar.

Africa is increasingly catching serious attention from investors around the world. For many countries, growth prospects remain strong: improving economic fundamentals, demographic tailwinds, rising consumption and infrastructure gaps make for a compelling growth narrative. But, along with potential comes volatility: currency swings, shallow markets, uneven regulation. That volatility forces a choice, do you try to […]

If you’re exploring investment opportunities in Africa, bonds are usually one of the first stopovers. The continent’s growth story, shifting interest-rate cycles, and rising corporate issuances mean there’s real activity for anyone looking to invest in Africa. But here’s the thing: not all bonds play by the same rules. Government debt and corporate paper behave […]

Introduction Agribusiness and mining are two of Africa’s biggest economic engines. One feeds the continent and supports nearly half of its workforce. The other powers global supply chains with the minerals needed for batteries, electric vehicles, and renewable energy. The real question for investors is simple: which one will drive Africa’s next decade of growth, […]