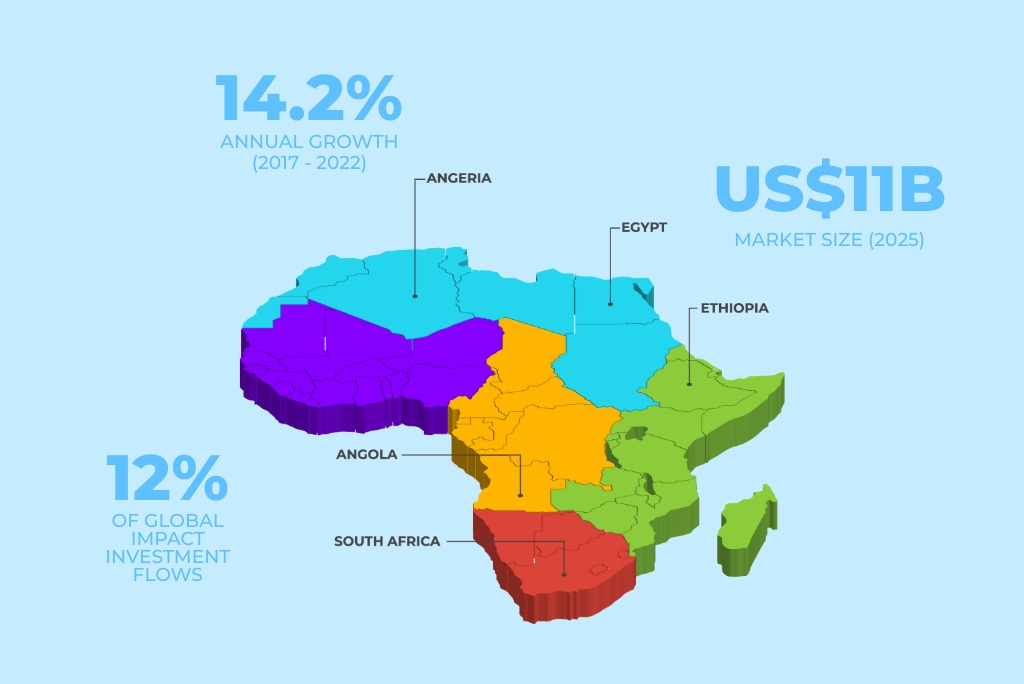

Impact investing isn’t just a moral checkbox in Africa anymore. It’s becoming a smart business. Investors who want financial return and meaningful social or environmental change are seeing that Africa offers some of the richest ground for both.

So yes, there’s lot of investment opportunities in Africa. The risk is there, policy, regulation, infrastructure, corruption, but the rewards are becoming harder to ignore.

What business opportunities in Africa are truly shining?

What stands out:

What holds investors back? And how are some places overcoming this?

Countries that do well tend to: offer stable policy frameworks; support blended finance; permit PPPs; invest in infrastructure; strengthen legal systems for property rights, contracts; partner with multilateral/lenders to de-risk projects.

If you’re thinking to invest (or advise others), here’s what to watch out for:

Investing in Africa with purpose isn’t charity. It’s a smart strategy. The numbers are increasingly in favor of those willing to engage with nuance and with courage.

Here’s the truth: Africa is at a moment. Young populations, lagging infrastructure with huge need, environmental pressure, digital transformation. Combine those with the right capital, governance, and partnerships and you get impact investing that doesn’t just do good,it does well.

Disclaimer: This article is intended for informational and educational purposes only. All data and statistics cited are sourced from reputable organizations, including the World Bank, UNDP, AfDB, Reuters, and regional development agencies, as referenced. While every effort has been made to verify the accuracy of the information, figures and projections may vary based on evolving market conditions. Readers are advised to conduct independent due diligence or consult a licensed financial advisor before making any investment decisions related to Africa or impact investing.

Sources:

Ecofin Agency

Home | Sustainable finance hub

Who Owns Africa+2AP News

swissshikanainvest.com+3The African Exponen Global Development & Investment Forum

WIRED

xnovainternational.com+2IQ-EQ+2

xnovainternational.com+2Africa For Investors

IQ-EQ+2Capmad.com

IQ-EQ

The African Exponent

xnovainternational.com

The African Exponent

The African Exponent+2The African Exponent+2

Reuters

Home | Sustainable finance hub

1. How does impact investing differ from traditional investing in Africa?

Traditional investing focuses purely on financial returns. Impact investing, on the other hand, blends financial goals with measurable social or environmental outcomes. In Africa, this might mean financing solar micro-grids that bring power to rural areas, investing in agribusinesses that reduce food waste, or supporting fintech startups improving financial inclusion. The key difference lies in intention and accountability, impact investors track both profit and purpose, while traditional investors usually stop at the balance sheet.

2. Which sectors in Africa offer the most impact investment opportunities?

The biggest opportunities sit where Africa’s needs and markets intersect. Renewable energy and clean power remain at the top, over 600 million people still lack electricity. Agribusiness follows closely, especially in value addition and logistics. Healthcare and education attract steady capital because access and infrastructure gaps are huge. Then there’s fintech, which continues to revolutionize payments, lending, and small business access to credit. Countries like Kenya, Nigeria, Rwanda, and Egypt are leading across these sectors.

3. How do investors measure social and environmental impact in Africa?

Impact measurement is evolving fast. Most investors use frameworks aligned with the UN Sustainable Development Goals (SDGs) and IRIS+ metrics developed by the Global Impact Investing Network (GIIN). They track indicators like jobs created, CO₂ avoided, households electrified, or students reached. Increasingly, investors also rely on third-party verification and outcome-based contracts to make sure the numbers actually mean something on the ground.

4. What financial returns can investors expect from impact investing in Africa?

Returns vary widely by sector and country, but they’re far from charity-level. The UNDP Africa Investment Insights 2025 report found that nearly a quarter of SDG-aligned opportunities deliver internal rates of return (IRR) between 15% and 25%. Clean energy projects, agribusiness value chains, and fintech ventures often yield competitive or even higher returns than traditional emerging-market investments. Of course, the flip side is higher operational and regulatory risk, which investors need to price in.

5. What are the key challenges of impact investing across African markets?

There’s no sugarcoating this, Africa’s challenges are real. Policy and regulatory uncertainty can spook investors. Infrastructure gaps, roads, energy grids, internet, still raise project costs. Access to affordable capital is limited, especially for early-stage enterprises. Currency fluctuations and data transparency issues add another layer of risk. Yet, countries addressing these gaps through stable regulation, blended finance frameworks, and public-private partnerships (like Kenya, Rwanda, and South Africa) are showing how the model can work.

Africa is increasingly catching serious attention from investors around the world. For many countries, growth prospects remain strong: improving economic fundamentals, demographic tailwinds, rising consumption and infrastructure gaps make for a compelling growth narrative. But, along with potential comes volatility: currency swings, shallow markets, uneven regulation. That volatility forces a choice, do you try to […]

If you’re exploring investment opportunities in Africa, bonds are usually one of the first stopovers. The continent’s growth story, shifting interest-rate cycles, and rising corporate issuances mean there’s real activity for anyone looking to invest in Africa. But here’s the thing: not all bonds play by the same rules. Government debt and corporate paper behave […]

Introduction Agribusiness and mining are two of Africa’s biggest economic engines. One feeds the continent and supports nearly half of its workforce. The other powers global supply chains with the minerals needed for batteries, electric vehicles, and renewable energy. The real question for investors is simple: which one will drive Africa’s next decade of growth, […]