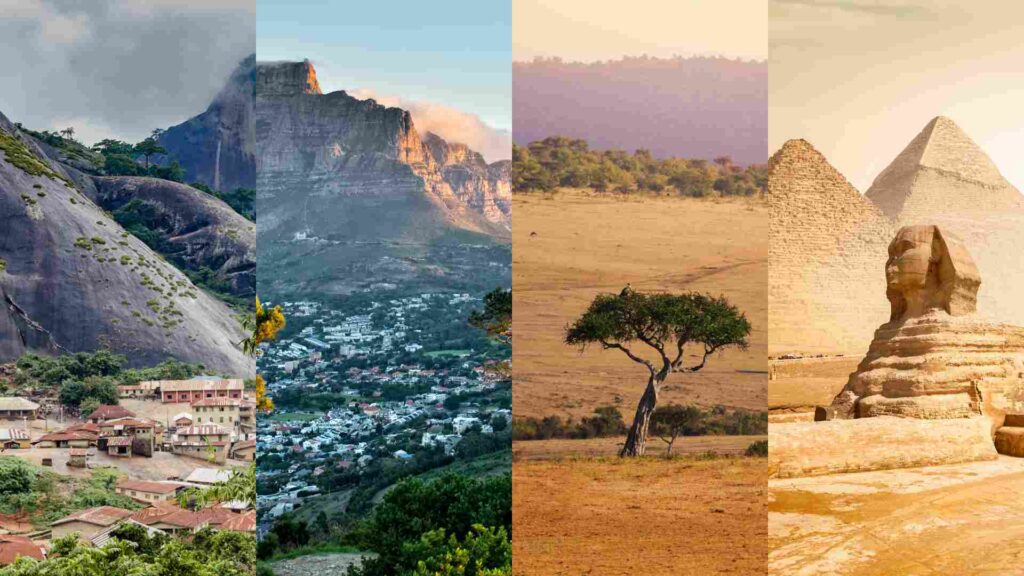

Interested in Investing in Africa in 2025

Africa has emerged as a favorite destination for investors who are wanting to diversify their portfolios and expand their operations because of the continent’s vast potential. As we reach the year 2025, the dynamic changes that are occurring in Africa’s investment sector will bring with them both opportunities and challenges.

This guide aims to shed light on the possibilities available to individuals who are interested in exploring investment opportunities in Africa by focusing on industries that are prepared to generate big profits and approaches that may be used to negotiate this busy market.

Understanding the African Investment Climate

Through the reduction of tariffs and the simplification of trade laws, the African Continental Free Trade Area (AfCFTA), which was established in 2019, intends to transform the largest free trade area in the world. This will be accomplished by increasing intra-African business. The appeal of the continent to investors has been significantly enhanced as a result of this initiative, which has created a market environment that is more connected and efficient.

However, in order to successfully invest in Africa, one must have a comprehensive

understanding of the continent’s many markets, legal regimes, and sociopolitical circumstances. Every nation faces unique challenges and opportunities, which necessitate thorough analysis and strategic planning in order to manage them effectively.

Key Sectors for Investment Opportunities in Africa

Renewable Energy

Africa is a leader in the field of renewable energy due to its abundance of natural resources. Morocco and South Africa are two examples of countries that have actively financed efforts related to solar and wind energy. For instance, Morocco’s Noor Solar Complex, which is one of the largest solar complexes in the world, shows the continent’s commitment to the development of energy sources that are less harmful to the environment.

Technology and Digital Infrastructure

The digital revolution is expanding across Africa as a result of significant investments having been made in internet infrastructure and data centers. It is important to note that the International Finance Corporation has made a $100 million investment in Raxio Group in order to distribute data centers throughout a number of African countries. This investment indicates the growing demand for digital infrastructure.

Agribusiness

Agriculture continues to be a driving force behind many African states. Both output and sustainability are being improved as a result of Aggradech’s inventions. As a result of the African Development Bank’s projection that the agricultural industry will be valued more than one trillion dollars by the year 2030, the bank stresses the tremendous potential of the sector.

Fintech

Due to the huge number of people who do not have bank accounts, Africa has emerged as a leading region for the development of financial systems. The introduction of mobile money systems such as M-Pesa in Kenya has resulted in a transformation of the financial services industry and has provided opportunities for new companies to fulfill the specific requirements of the African continent.

Healthcare

When it comes to the healthcare industry, there are opportunities that are begging to be invested in, ranging from telemedicine to the manufacturing of pharmaceuticals. Additionally, the COVID-19 outbreak has brought to light the importance of robust healthcare systems, which has resulted in an increased focus on this sector of the economy.

Top Countries to Consider for Investment

Nigeria

Because it is the largest economy in Africa, Nigeria offers opportunities in the fields of financial technology, agriculture, and the entertainment industry. The nation’s youthful population and the spirit of entrepreneurship combine to produce a dynamic market for a wide variety of different types of businesses.

South Africa

With a well-developed infrastructure and diverse economy, South Africa is attractive for investments in renewable energy, technology, and real estate. Promoting private sector investment in renewable energy has been much aided by the Renewable Energy Independent Power Producer Procurement Program (REIPPPP).

Kenya

Known as the “Silicon Savannah,” Kenya has a thriving tech ecosystem, making it ideal for technology and agribusiness investments. Nairobi has become a hub for startups and innovation in the region.

Egypt

Egypt’s industrial and tourism sectors have been reinforced as a result of the country’s strategic location and economic reforms, which has resulted in a variety of investment opportunities in Africa being made available. Even more appealing is the fact that the nation places a strong priority on the development of its infrastructure.

Strategies for Successful Investment

Conduct Thorough Due Diligence

Understanding local market dynamics, regulatory environments, and cultural nuances is crucial. Engaging with local experts and conducting comprehensive market research can mitigate risks.

Leverage Local Partnerships

When you collaborate with local businesses, you might have access to valuable analysis and assistance in entering the market. In addition, collaborations that assist in the development of trust and the negotiation of bureaucratic procedures are beneficial.

Emphasize impactful and sustainable investments

Recent years have seen an increase in the total amount of investments that take into account social and environmental concerns. Two industries that not only contribute to the generation of income but also contribute to the maintenance of consistent growth are healthcare and renewable energy.

Africa’s investment climate can be influenced by political and economic changes. Keeping abreast of current events and policy shifts is essential for informed decision-making.

Conclusion

Investing in Africa in 2025 will provide a scene full of opportunities spanning many sectors. If investors have a full awareness of Africa’s different markets, if they use clever alliances, and if they focus on sustainable investments, they could be able to take advantage of its great potential. As is often the case, to effectively negotiate the challenges and reap the rewards of investing in this vibrant continent, thorough study and a professional strategy are absolutely vital.

Sources:

$100 million investment in Raxio Group

one trillion dollars by the year 2030

FAQ

1. Why is Africa a good investment opportunity in 2025?

Africa’s investment allure in 2025 stems from several compelling factors:

Economic Growth: The continent is experiencing robust economic expansion, with a projected private equity market deal value of approximately US$900.80 million by the end of 2025.

Demographic Advantage: Africa’s youthful and rapidly growing population fuels a burgeoning middle class, escalating demand for diverse goods and services.

Resource Wealth: Abundant in natural resources, Africa is pivotal in the global energy transition, boasting substantial reserves of minerals essential for decarbonization efforts.

Technological Advancement: The digital revolution is gaining momentum, with significant investments in digital infrastructure enhancing connectivity and fostering innovation.

These elements collectively position Africa as a promising frontier for investment in 2025.

2. Which sectors are the most profitable for investment in Africa?

Several sectors stand out for their profitability and growth potential:

Renewable Energy: With increasing global emphasis on sustainability, investments in solar, wind, and hydroelectric projects are surging.

Agriculture: Leveraging vast arable land, agribusinesses are capitalizing on opportunities in food production and export.

Telecommunications: The rapid expansion of mobile and internet penetration presents lucrative prospects for telecom companies.

Financial Technology (Fintech): Innovations in mobile banking and digital payments are revolutionizing financial services, attracting substantial investments.

Consumer Goods and E-commerce: Urbanization and a growing middle class are driving demand for consumer products and online retail platforms.

Investing in these sectors aligns with Africa’s developmental trajectory and market needs.

3. How can foreign investors start a business in Africa?

Initiating a business venture in Africa involves several critical steps:

Market Research: Conduct comprehensive analyses to identify viable markets and understand local consumer behaviors.

Legal Compliance: Familiarize yourself with the regulatory frameworks of the target country, including business registration, taxation, and foreign exchange controls.

Local Partnerships: Collaborate with local entities to navigate cultural nuances and establish a robust operational presence.

Investment Approvals: Secure necessary permits and adhere to sector-specific regulations to ensure lawful operations.

Risk Assessment: Evaluate potential risks and develop mitigation strategies to safeguard your investment.

Engaging with local legal and business consultants can facilitate a smoother entry into African markets.

4. What are the risks of investing in Africa, and how to mitigate them?

Investing in Africa presents certain risks, including:

Political Instability: Some regions may experience governmental changes or civil unrest.

Regulatory Uncertainty: Inconsistent legal frameworks can pose compliance challenges.

Infrastructure Deficiencies: Limited infrastructure may affect logistics and operations.

Currency Fluctuations: Exchange rate volatility can impact profitability.

Mitigation Strategies:

Political Risk Insurance: Protects against losses from political events.

Thorough Due Diligence: Assess the political and economic climate of the target country.

Diversification: Spread investments across various regions and sectors to minimize exposure.

Local Engagement: Partner with local firms to leverage their market expertise and networks.

Implementing these strategies can enhance resilience against potential investment risks.

5. What are the legal and regulatory requirements for investing in Africa?

Legal and regulatory requirements vary across African nations but commonly include:

Business Registration: Establish a legal entity compliant with local laws.

Taxation Compliance: Understand and adhere to tax obligations, including corporate taxes and value-added tax (VAT).

Foreign Exchange Controls: Be aware of regulations governing the repatriation of profits and currency conversions.

Sector-Specific Regulations: Certain industries may have additional requirements, such as local ownership quotas or environmental assessments.

Consulting with legal experts familiar with the specific country’s laws is crucial to ensure compliance and facilitate a successful investment.

By addressing these considerations with due diligence and strategic planning, investors can effectively navigate Africa’s promising yet complex investment landscape.