With the three new refineries scheduled to greatly increase Nigeria’s refining capacity, the country is about to enter a transforming period in its petroleum sector. This growth not only promises to lessen Nigeria’s long-standing dependence on imported refined goods but also helps to establish the nation as a growing center of African energy generation. These developments expose a wealth of possibilities in the oil and gas industry for investors looking at the continent, therefore highlighting the potential of investing in Africa‘s changing energy scene.

Aliko Dangote, the wealthiest man in Africa, is the driving force behind the massive Dangote Petroleum Refinery, which is at the forefront of this turnaround in the economy. This single-train refinery, which is valued at $20 billion and is situated in the Lekki Free Zone near Lagos, is the largest refinery in the world and has the capacity to process 650,000 barrels of crude oil on a daily basis. The refinery began operations in January 2024, and it is anticipated that it will soon achieve its maximum capacity for operations.

It is important to note that the Dangote Refinery has had a huge impact on the energy landscape in Nigeria. When all of the refined product requirements are met, there will be no need for imports, which will result in a reduction in the amount of foreign currency spent and an improvement in energy security. Furthermore, the additional output is intended for export, which brings about the establishment of Nigeria as a net exporter of refined petroleum products.

Along with private sector projects, the Nigerian government is aggressively modernizing its state-owned refineries. One example of major rehabilitation is the Port Harcourt Refinery. Currently running at 70% capacity, the older 60,000 barrels daily (bpd) plant started operations in December 2024. Plans call for the integration of a new 150,000 bpd unit, therefore increasing the production of the refinery.

Likewise, the Warri Refinery just began running again after thorough renovations. These initiatives complement a more general plan to improve domestic refining capacity, lower import reliance, and boost local economies.

Complementing these large-scale projects is the rise of modular refineries, which offer a more flexible and cost-effective approach to refining. These smaller-scale facilities are designed to process between 5,000 to 30,000 bpd and can be constructed in a fraction of the time required for traditional refineries. Several modular refineries are in various stages of development across Nigeria, contributing an estimated additional capacity of 140,000 bpd to the nation’s refining landscape.

However, challenges persist. Many modular refineries face hurdles in securing adequate crude oil supplies, which hampers their operational efficiency. The Nigerian National Petroleum Company Limited (NNPC) has initiated discussions to address these supply issues, aiming to ensure that both large-scale and modular refineries receive the necessary feedstock to operate optimally.

The expansion of Nigeria’s refining capacity heralds a wealth of investment opportunities in Africa‘s energy sector. The African Export–Import Bank (Afreximbank) has launched a $3 billion financing initiative aimed at supporting the purchase of refined oil products, further bolstering the continent’s energy infrastructure.

Moreover, the upcoming Invest in African Energy (IAE) 2025 conference is set to highlight growth opportunities in Africa’s downstream supply chain. The event will explore how the expansion of the downstream sector can strengthen supply chains, enhance refining capacity, and drive sustainable economic growth through infrastructure investment and strategic partnerships.

While the outlook is promising, the journey is not devoid of challenges. Ensuring consistent crude oil supply remains a critical concern, as evidenced by the Dangote Refinery’s recent need to import crude to sustain operations. Additionally, the quality of products from modular refineries has come under scrutiny, with experts highlighting issues related to product specifications and sulfur content.

Furthermore, the financial viability of these projects is contingent upon a stable economic environment. Fluctuations in global oil prices, regulatory uncertainties, and infrastructural deficits pose potential risks that investors must navigate.

Nigeria’s initiative to commission three new refineries marks a pivotal moment in the nation’s quest for energy self-sufficiency and economic diversification. These developments not only promise to transform the domestic petroleum landscape but also position Nigeria as a key player in the global energy market. For investors, the burgeoning opportunities in Africa’s oil and gas sector are manifold, offering avenues to partake in the continent’s dynamic growth trajectory. As with any investment, thorough due diligence and an understanding of the local context are imperative to harness the full potential of these emerging prospects.

Sources:

Nigeria’s Dangote Refinery to operate at full capacity in 30 days, executive says

REFINERY NEWS ROUNDUP: Upgrades, new plants in focus in Africa

Nigeria’s NNPC, Dangote Refinery in talks to extend naira-based crude supply deal

Afreximbank Launches $3B Plan to Boost Africa’s Oil Refining Capacity

Expert Alleges Modular Refineries in Nigeria Don’t Produce On-spec Products

1. Why is Nigeria building new refineries?

Nigeria is building new refineries to solve a long-standing challenge: although importing over 80% of its refined petroleum products, it is Africa’s biggest crude oil producer. This disparity has taxed foreign reserves, raised local gasoline prices, and put the nation in front of shocks from the world market. Nigeria wants to reach energy self-sufficiency, lower its import bill, and build a strong downstream industry inviting foreign direct investment by raising local refining capacity. This is a calculated action highlighting more general corporate prospects in Africa, especially in fields ready for industrialization and infrastructure development.

2. How many refineries exist in Nigeria now?

Nigeria has a mix of conventional and modular refineries as of 2025, with more than 20 refining plants in several phases of development and operation. Although historically they have struggled with inefficiency, the three main state-owned refineries—Port Harcourt, Warri, and Kaduna—are now under gradual restoration. Changing the story are private-sector operators like Dangote Petroleum Refinery, now the biggest modular refinery in Africa. Taken together, they help to create a changing refining ecology meant not just to satisfy fflocal needs but also to make Nigeria a regional export powerhouse. For investors wishing to make investments in Africa’s energy rebirth, this expansion points to a rich environment.

3. Who are the key investors in Nigeria’s new refineries?

Aliko Dangote, whose self-funded $20 billion refinery facility in Lagos is a monument to great faith in Nigeria’s industrial future, takes front stage. Beyond Dangote, funding has been poured into refinery construction and logistics by foreign and regional financiers like Africa Finance Corporation (AFC) and the African Export-Import Bank (Afreximbank). Also starting modular refineries supported by public-private alliances are some indigenous oil businesses. These businesses represent the rising impetus behind investment prospects in Africa’s energy sector, where long-term demand, strategic position, and legislative reforms make Nigeria an ever more appealing frontier.

4. How will the new refineries impact Nigeria’s economy?

There are really important ripple effects. Nigeria stands to save billions in foreign exchange yearly by significantly lowering the importation of refined goods—money better used for infrastructure, education, and healthcare. Tens of thousands of direct and indirect employment will be generated by the refineries, as well as stimulation of related businesses and attraction of worldwide supply chains. Most critically, perhaps, surplus refined goods will be exported from West and Central Africa, generating foreign income and thereby improving Nigeria’s trade balance. These refineries are economic catalysts rather than just infrastructure for worldwide investors looking at commercial prospects in Africa.

5. How does the development of new refineries align with Nigeria’s energy policies?

Under Nigeria’s Decade of Gas and Energy Transition Plan, which seeks to turn the nation from a crude exporter to a value-added energy hub, the development is a pillar of importance. Emphasizing deregulation, private investment, and local refining capacity—principles expressed in these refinery projects—the National Petroleum Policy and Downstream Reform Act advocates Nigeria is paving the path for long-term stability, investor trust, and regional leadership in energy supplies by matching policy with pragmatic development. These modern refineries are essentially policy-driven platforms for everyone wishing to invest in Africa’s future, not only industrial advances.

Africa’s investment landscape is undergoing a dynamic transformation. Foreign direct investment (FDI) flows to the continent have rebounded from pandemic-era lows and are diversifying across new sectors. Global investors are increasingly eyeing investment opportunities in Africa, drawn by the region’s growth prospects and rich resource base, even as they navigate persistent challenges. This blog provides a […]

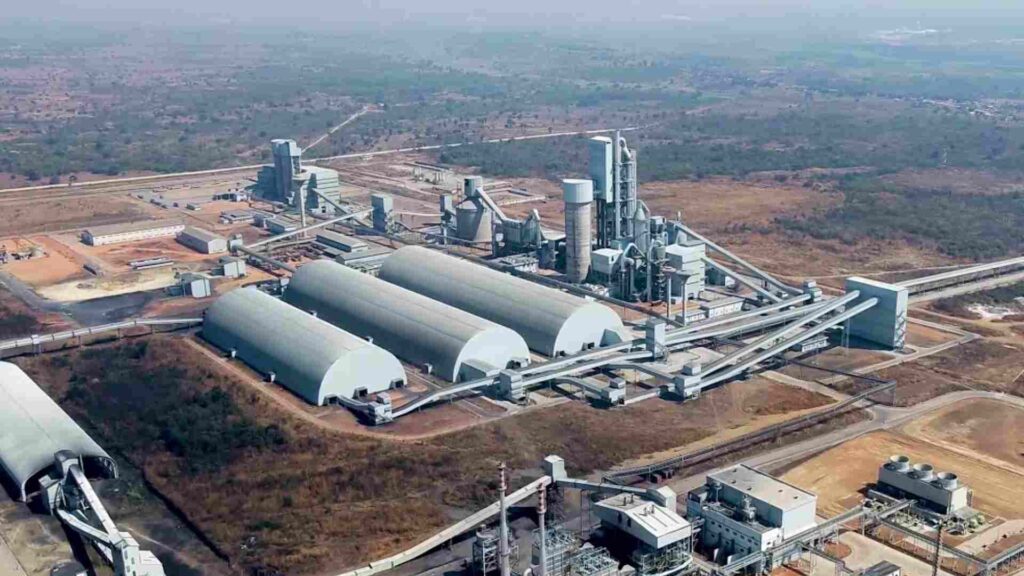

Aliko Dangote — Africa’s richest man and a powerhouse industrialist — is at it again with ambitious projects that have everyone talking. In a recent announcement, Dangote unveiled plans to build a massive new cement factory in Ogun State alongside Nigeria’s largest seaport at the Olokola Free Trade Zone (OKFTZ). These twin developments are poised to boost Nigeria’s […]

Africa has emerged as a favorite destination for investors who are wanting to diversify their portfolios and expand their operations because of the continent’s vast potential. As we reach the year 2025, the dynamic changes that are occurring in Africa’s investment sector will bring with them both opportunities and challenges. This guide aims to shed […]